Still Chasing Liquidity? Let it Come to You.

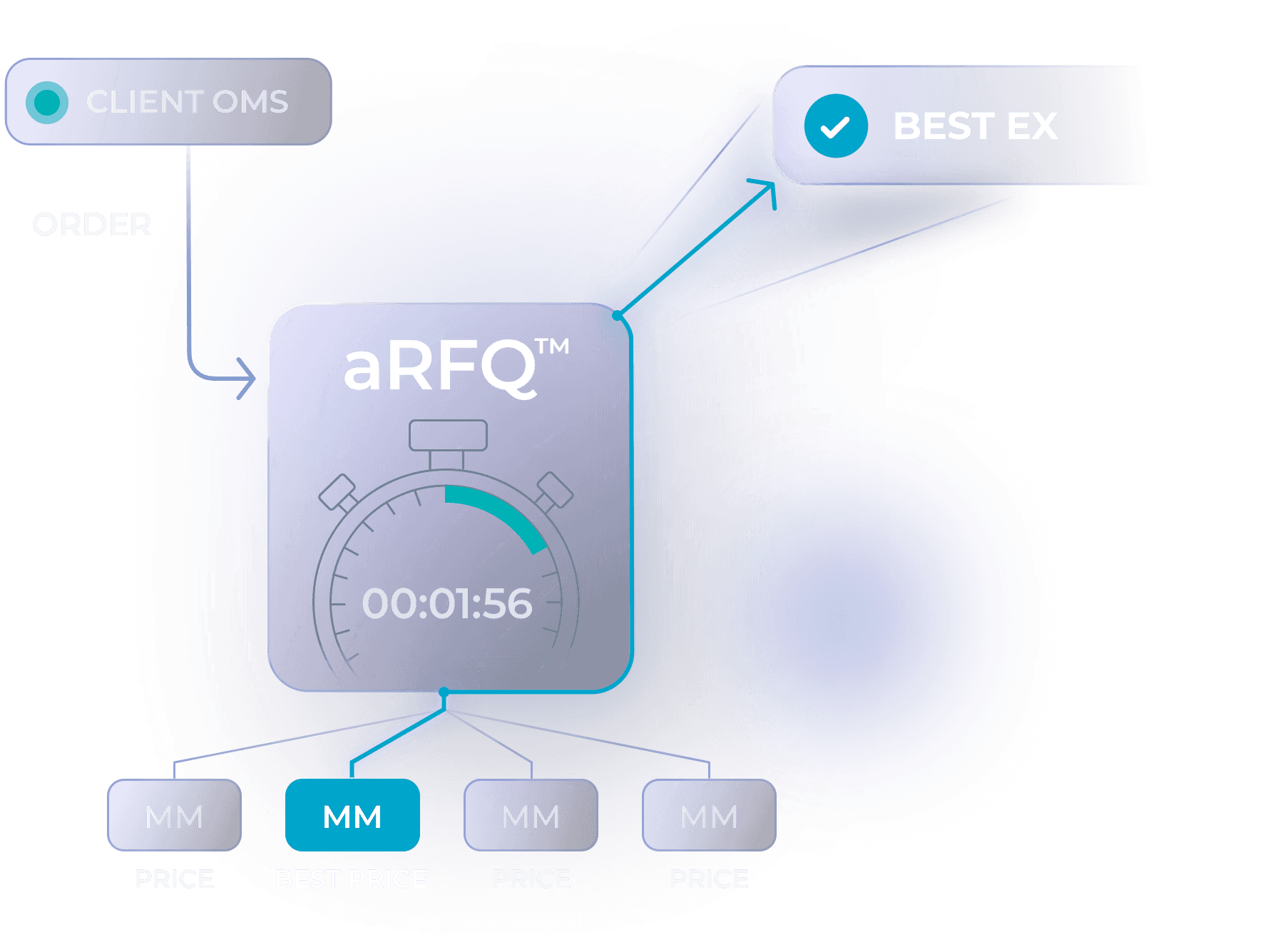

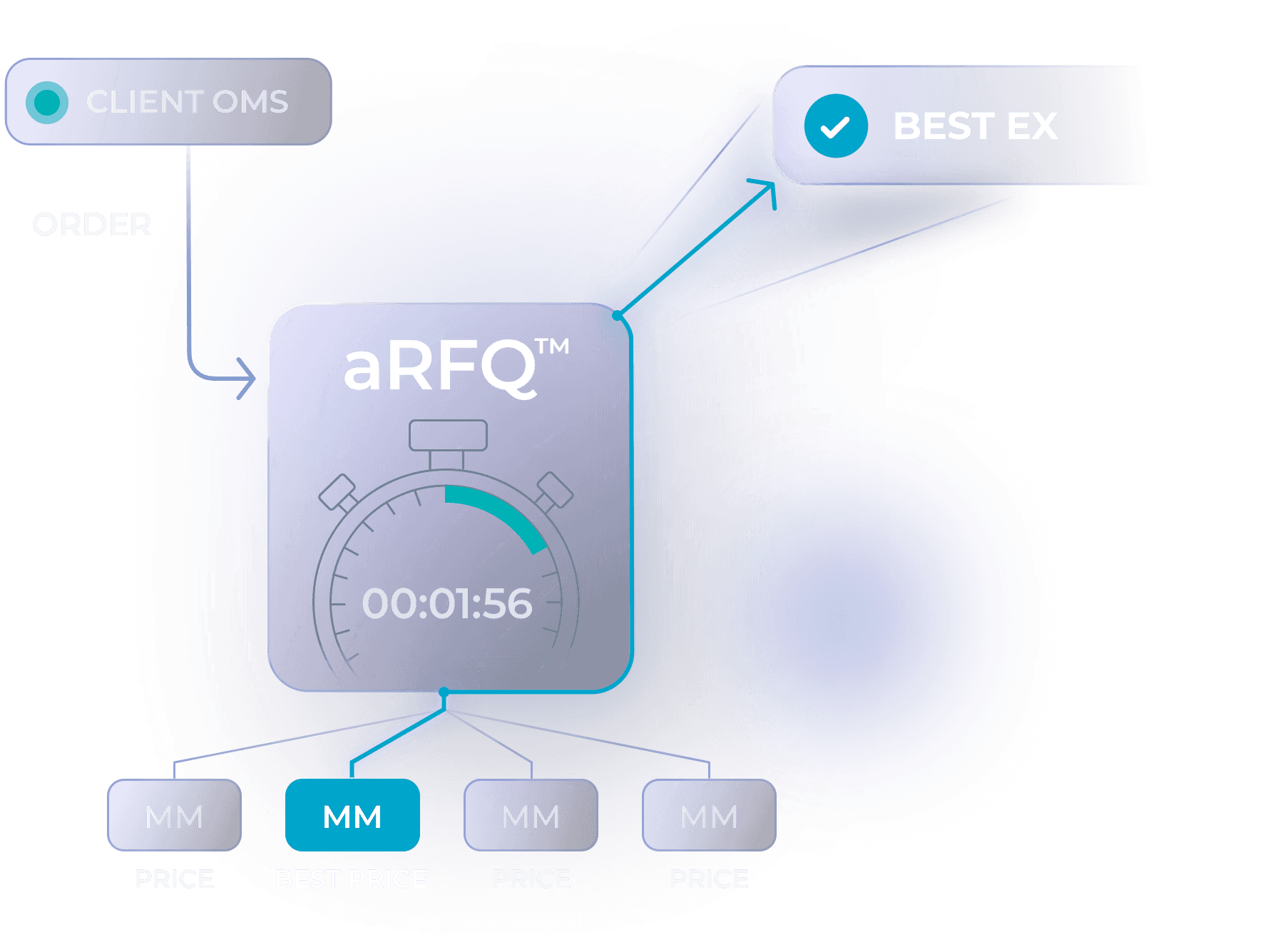

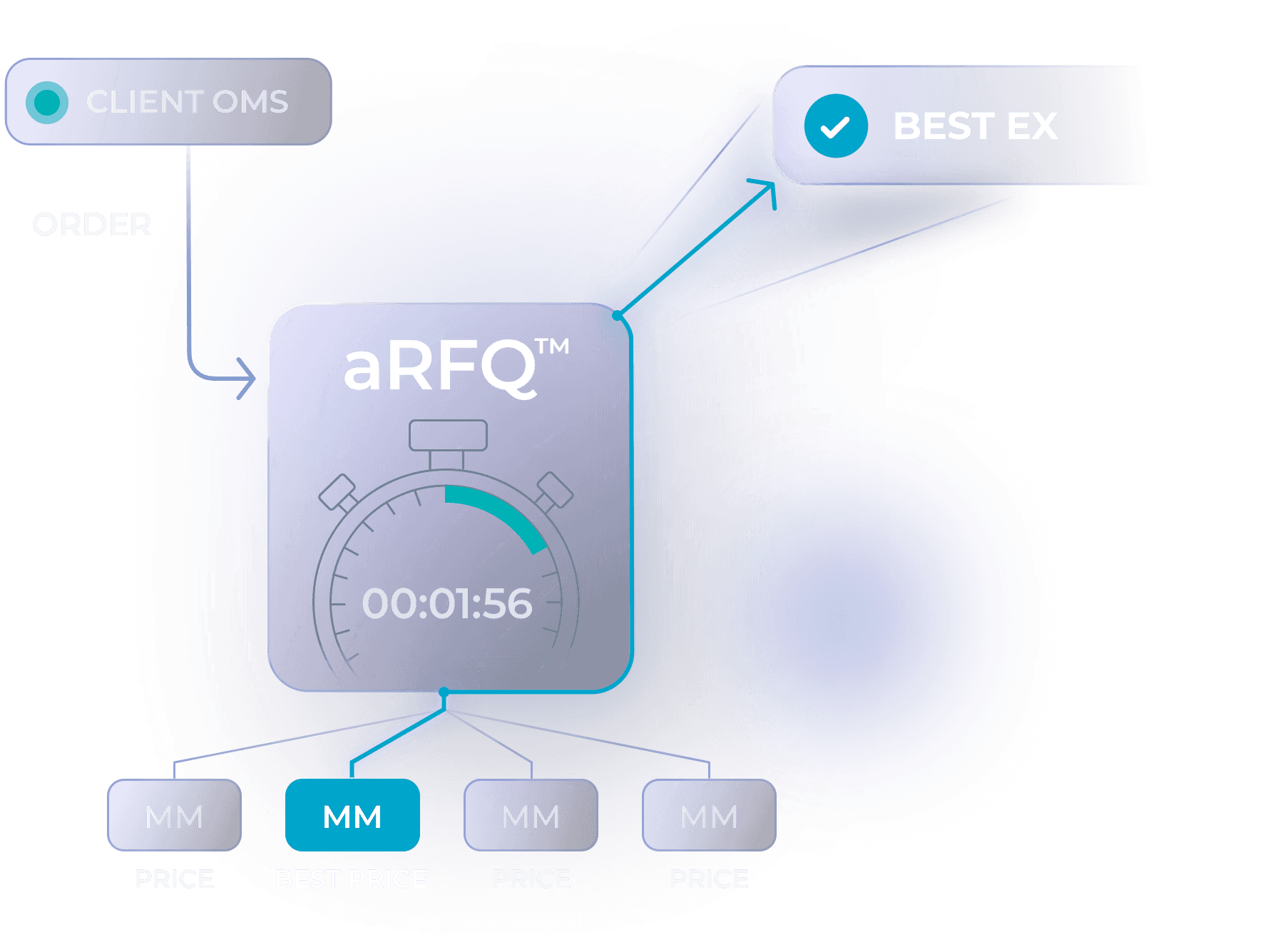

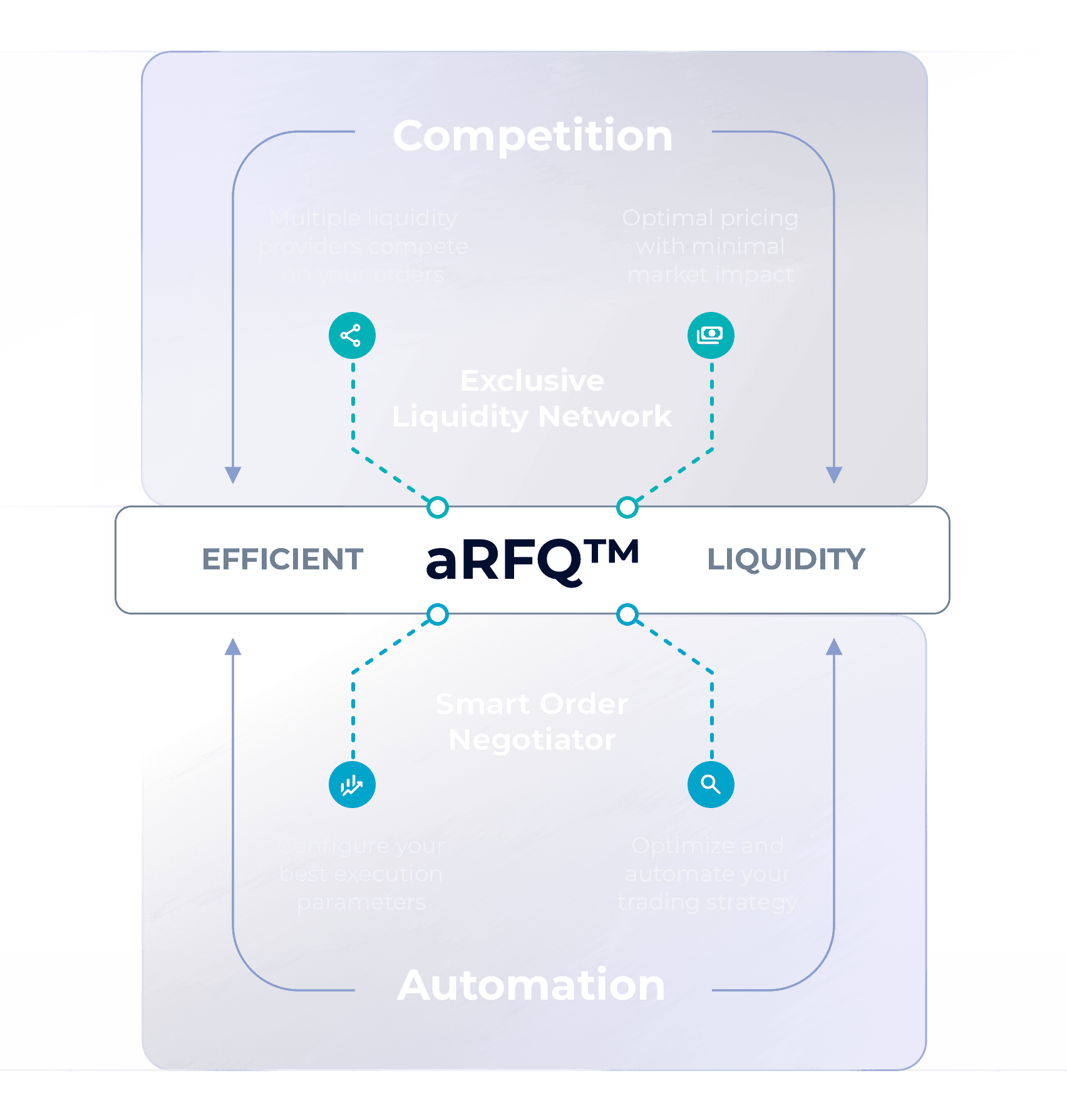

At QwickRoute’s core is aRFQ™—automating competitive routing for cleaner fills and best-price execution, built by traders for traders.

Distinguish Your Execution

Distinguish Your Execution

Distinguish Your Execution

Distinguish Your Execution

Unlock efficient, high-quality execution with QwickRoute’s core automation tools.

aRFQ™ Intelligence

aRFQ™ Intelligence

aRFQ™ Intelligence

aRFQ™ Intelligence

See how aRFQ™ optimizes every order, for both symbol and size, by implementing competitive auction logic.

Order Competition

Minimize Market Impact

Post Trade Analytics

LImit Order Management

Order Lifecycle Transparency

Protect Info Leakage

Order Competition

Minimize Market Impact

Post Trade Analytics

Liquidity | Struggling to find liquidity?

Quality | Demand quality & cost efficiency?

Transparency | Worried about order information leakage?

Compliance | Navigating evolving regulations?

Automation | Do you automate your competition?

Liquidity | Struggling to find liquidity?

Quality | Demand quality & cost efficiency?

Transparency | Worried about order information leakage?

Compliance | Navigating evolving regulations?

Automation | Do you automate your competition?

Performance Overview

Performance Overview

Performance Overview

Performance Overview

Get a clear view of your trading progress with historical metrics and easy-to-read execution summaries.

Execution Trends

Performance

Last 24hrs

See Results

Review past auctions and results

Track improvements in pricing and speed

Measure consistency across workflows

Execution Trends

Performance

Last 24hrs

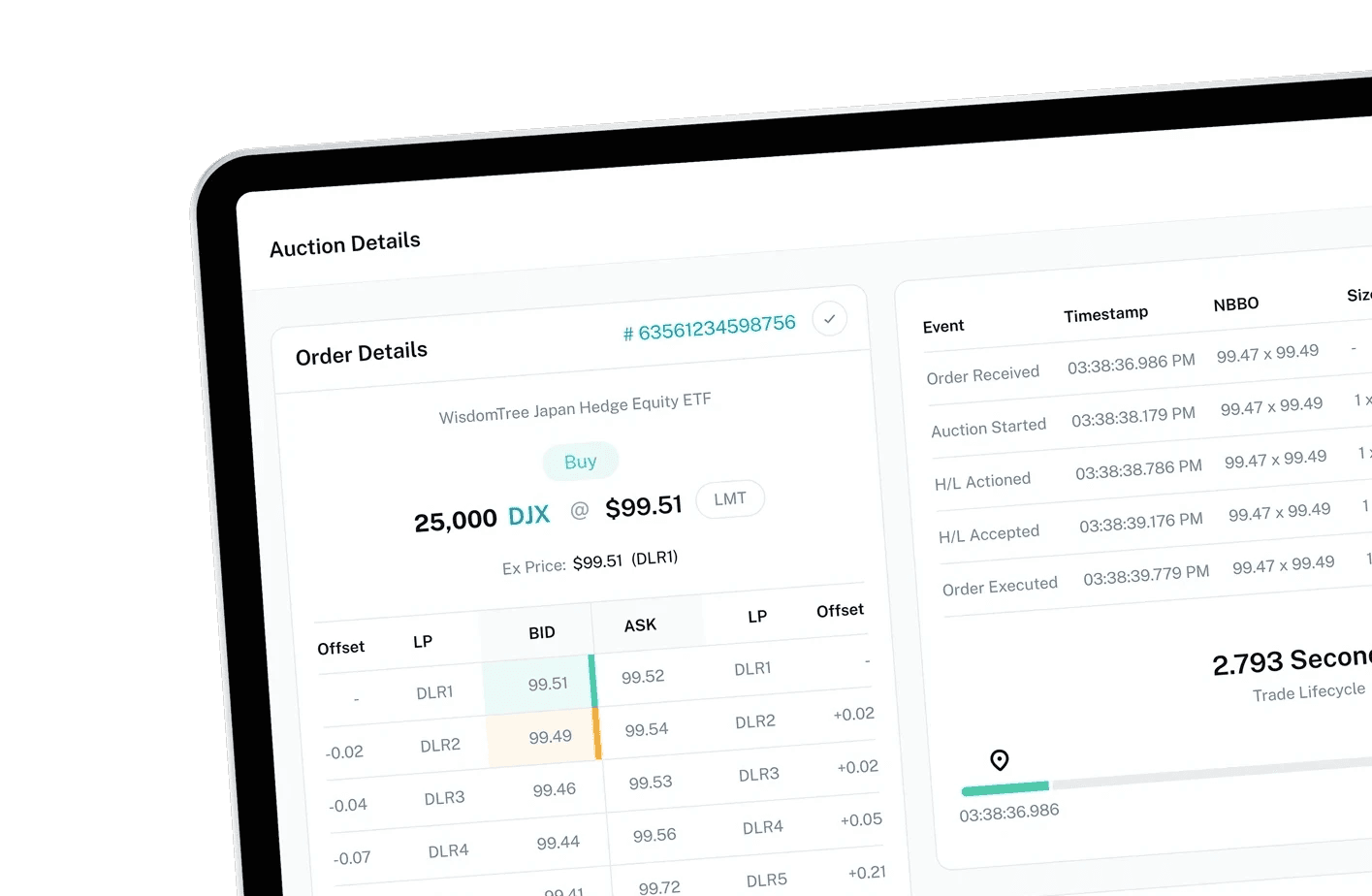

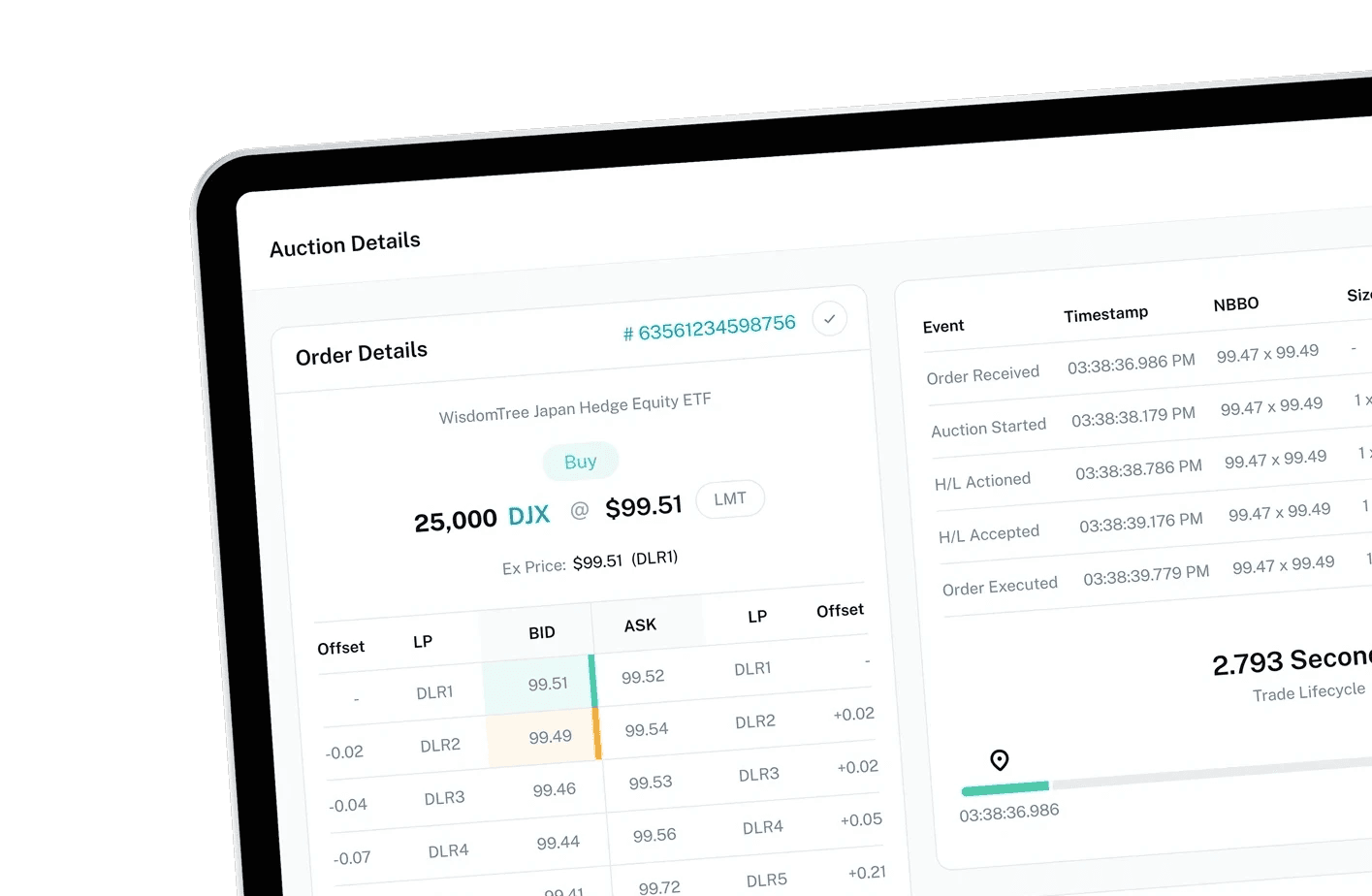

Visualize Every Auction

Visualize Every Auction

Visualize Every Auction

Visualize Every Auction

Access real-time auction details, daily order activity and history, execution analytics and auction parameters in the QwickRoute portal tool.

What Powers the QwickRoute Experience?

What Powers the QwickRoute Experience?

Automating RFQs in a data-driven future.

QwickRoute provides seamless access to top Liquidity Providers, empowering users to expand capacity, mitigate risk, and stay in control. By automating RFQ through intelligent rule-based decision making, the platform delivers faster, more consistent execution results.

Liquidity Optimization

QwickRoute enhances RFQs by selecting top Liquidity Providers, driving sharper price discovery, and using a deep pooled network that strengthens participation and supports efficient negotiation across symbols.

Smart Dealer Selector

Order-Driven Price Discovery

Expansive Liquidity Pool

Order Control

QwickRoute lets users stage and trigger auctions with marketability rules, manage spreads as conditions shift, and merge multiple orders into a single RFQ to streamline workflow and improve execution.

Limit Order Management

Spread Order Management

Order Merging

Workflow Management

QwickRoute supports list trading and ETF algo strategies for coordinated execution, ties RFQs into familiar models, and boosts results with Best Execution benefits and reliable CAT reporting across workflows.

List Trading

ETF & Algo Strategies

Best Ex & Compliance

Want a Visual Edge?

The QwickRoute Portal provides a real-time window into auction dynamics, quotes, execution details as they happen. It’s completely optional and designed for those who value transparency at a glance.

Liquidity Optimization

QwickRoute enhances RFQs by selecting top Liquidity Providers, driving sharper price discovery, and using a deep pooled network that strengthens participation and supports efficient negotiation across symbols.

Smart Dealer Selector

Order-Driven Price Discovery

Expansive Liquidity Pool

Order Control

QwickRoute lets users stage and trigger auctions with marketability rules, manage spreads as conditions shift, and merge multiple orders into a single RFQ to streamline workflow and improve execution.

Limit Order Management

Customizable Auction

Customizable Auction

Workflow Management

QwickRoute supports list trading and ETF algo strategies for coordinated execution, ties RFQs into familiar models, and boosts results with Best Execution benefits and reliable CAT reporting across workflows.

List Trading

ETF & Algo Strategies

Best Ex & Compliance

Want a Visual Edge?

The QwickRoute Portal provides a real-time window into auction dynamics, quotes, execution details as they happen. It’s completely optional and designed for those who value transparency at a glance.

Liquidity Optimization

QwickRoute enhances RFQs by selecting top Liquidity Providers, driving sharper price discovery, and using a deep pooled network that strengthens participation and supports efficient negotiation across symbols.

Smart Dealer Selector

Order-Driven Price Discovery

Expansive Liquidity Pool

Order Control

QwickRoute lets users stage and trigger auctions with marketability rules, manage spreads as conditions shift, and merge multiple orders into a single RFQ to streamline workflow and improve execution.

Limit Order Management

Spread Order Management

Order Merging

Workflow Management

QwickRoute supports list trading and ETF algo strategies for coordinated execution, ties RFQs into familiar models, and boosts results with Best Execution benefits and reliable CAT reporting across workflows.

List Trading

ETF & Algo Strategies

Best Ex & Compliance

Want a Visual Edge?

The QwickRoute Portal provides a real-time window into auction dynamics, quotes, execution details as they happen. It’s completely optional and designed for those who value transparency at a glance.

Liquidity Optimization

QwickRoute enhances RFQs by selecting top Liquidity Providers, driving sharper price discovery, and using a deep pooled network that strengthens participation and supports efficient negotiation across symbols.

Smart Dealer Selector

Order-Driven Price Discovery

Expansive Liquidity Pool

Order Control

The On-Demand Liquidity Auction is a proprietary QwickRoute algorithm that leverages a competitive auction process to aggregate liquidity from multiple counter-parties. A single, optimized execution price with minimal slippage and market impact.

Limit Order Management

Customizable Auction

Customizable Auction

Workflow Management

QwickRoute supports list trading and ETF algo strategies for coordinated execution, ties RFQs into familiar models, and boosts results with Best Execution benefits and reliable CAT reporting across workflows.

Live Order Monitoring

Adaptive Algo Controls

Adaptive Algo Controls

Want a Visual Edge?

The QwickRoute Portal provides a real-time window into auction dynamics, quotes, execution details as they happen. It’s completely optional and designed for those who value transparency at a glance.

Harness liquidity and command the market

Harness liquidity and command the market

Trade Smarter with aRFQ™

Trade Smarter with aRFQ™

The Order Type Built for Automated RFQs

Elevate your trading with aRFQ™, QwickRoute’s advanced liquidity-seeking order type. Designed for best execution, aRFQ™ uses a competitive auction process to optimize transactions and minimize market impact. Whether managing single orders or complex baskets, aRFQ™ scales seamlessly, merging orders and delivering a single execution price for maximum efficiency.

The competition never left. It just got faster.

Liquidity now meets automated workflows with aRFQ™ — bringing competitive pricing and intelligent execution.

Your Edge

Competitive Auctions

Optimal Execution

Scalable Liquidity

Your Edge

Competitive Auctions

Optimal Execution

Scalable Liquidity

Liquidity | Struggling to find liquidity?

Quality | Demand quality & cost efficiency?

Transparency | Worried about order information leakage?

Compliance | Navigating evolving regulations?

Automation | Do you automate your competition?

Liquidity | Struggling to find liquidity?

Quality | Demand quality & cost efficiency?

Transparency | Worried about order information leakage?

Compliance | Navigating evolving regulations?

Automation | Do you automate your competition?

Liquidity | Struggling to find liquidity?

Quality | Demand quality & cost efficiency?

Transparency | Worried about order information leakage?

Compliance | Navigating evolving regulations?

Automation | Do you automate your competition?

Liquidity Created

JUD

NBBO LIT SIZE

Average Auction

LRL

SECONDS

NBBO or Better

WSJ

ORDERS EXECUTED

Want More? View execution data across live aRFQ™ trading scenarios

Want More? View execution data across live aRFQ™ trading scenarios

Explore detailed execution metrics and real-world outcomes from live aRFQ™ orders, including liquidity depth, response times, and execution quality across varying conditions.

Explore detailed execution metrics and real-world outcomes from live aRFQ™ orders, including liquidity depth, response times, and execution quality across varying conditions.

Trade Smarter with aRFQ™

Trade Smarter with aRFQ™

The Order Type Built for Automated RFQs

Elevate your trading with aRFQ™, QwickRoute’s advanced liquidity-seeking order type. Designed for best execution, aRFQ™ uses a competitive auction process to optimize transactions and minimize market impact. Whether managing single orders or complex baskets, aRFQ™ scales seamlessly, merging orders and delivering a single execution price for maximum efficiency.

The competition never left. It just got faster.

Liquidity now meets automated workflows with aRFQ™ — bringing competitive pricing and intelligent execution.

Your Edge

Competitive Auctions

Optimal Execution

Scalable Liquidity

ALGO Spotlight

Does your ETF algo aRFQ™?

If not, QwickRoute’s aRFQ™ is the answer.

Growth in liquidity sources and trading protocols like RFQ is disrupting the market and accelerating automation. Enjoy the flexibility and advanced capabilities of the aRFQ™ order type.

Access Enhanced Liquidity.

Access Enhanced Liquidity.

Access Enhanced Liquidity.

Utilize Smart Order Negotiation.

Utilize Smart Order Negotiation.

Utilize Smart Order Negotiation.

Gain Data-Driven Insights.

Gain Data-Driven Insights.

Gain Data-Driven Insights.

Harness liquidity and command the market

Harness liquidity and command the market

FAQs

FAQs

Common Questions

Discover responses to common asked questions about our product and services.

What is QwickRoute’s aRFQ™ and how does it benefit investors?

QwickRoute’s aRFQ™ is a premium custom algorithmic trading solution designed for institutional investors and broker-dealers. It leverages advanced technology to automate liquidity-seeking strategies, enhancing trading performance and execution quality. By inviting the largest banks and broker-dealers to provide optimal pricing with minimal market impact, QwickRoute’s aRFQ™ ensures efficient and effective trading outcomes. The Smart Order Negotiator further refines your trading strategy to achieve the best possible execution.

How does QwickRoute’s aRFQ™ ensure transparency and data-driven insights?

What advanced features does QwickRoute’s aRFQ™ offer for optimal trading execution?

What is QwickRoute’s aRFQ™ and how does it benefit investors?

QwickRoute’s aRFQ™ is a premium custom algorithmic trading solution designed for institutional investors and broker-dealers. It leverages advanced technology to automate liquidity-seeking strategies, enhancing trading performance and execution quality. By inviting the largest banks and broker-dealers to provide optimal pricing with minimal market impact, QwickRoute’s aRFQ™ ensures efficient and effective trading outcomes. The Smart Order Negotiator further refines your trading strategy to achieve the best possible execution.

How does QwickRoute’s aRFQ™ ensure transparency and data-driven insights?

What advanced features does QwickRoute’s aRFQ™ offer for optimal trading execution?

What is QwickRoute’s aRFQ™ and how does it benefit investors?

QwickRoute’s aRFQ™ is a premium custom algorithmic trading solution designed for institutional investors and broker-dealers. It leverages advanced technology to automate liquidity-seeking strategies, enhancing trading performance and execution quality. By inviting the largest banks and broker-dealers to provide optimal pricing with minimal market impact, QwickRoute’s aRFQ™ ensures efficient and effective trading outcomes. The Smart Order Negotiator further refines your trading strategy to achieve the best possible execution.

How does QwickRoute’s aRFQ™ ensure transparency and data-driven insights?

What advanced features does QwickRoute’s aRFQ™ offer for optimal trading execution?

Order Routing & Execution

Covers how orders are routed, qualified, auctioned, and executed through QwickRoute’s aRFQ™ workflow.

How can I route orders to QwickRoute?

How does QwickRoute aRFQ™ execute orders?

What if I send multiple orders in one symbol?

Transparency & Monitoring

Explains how clients can monitor auctions in real time, verify execution quality, and access audit trails.

Can I watch the auction process in real time?

How do I know an order has received best execution?

Can I receive an audit trail for each auction?

Compliance & Reporting

Details regulatory compliance, reporting, and how QwickRoute simplifies trading relationships.

Is aRFQ™ fully compliant with Reg NMS requirements?

Is aRFQ™ compliant with CAT reporting requirements?

Do I need trading relationships with each liquidity provider?

Order Routing & Execution

Covers how orders are routed, qualified, auctioned, and executed through QwickRoute’s aRFQ™ workflow.

How can I route orders to QwickRoute?

How does QwickRoute aRFQ™ execute orders?

What if I send multiple orders in one symbol?

Transparency & Monitoring

Explains how clients can monitor auctions in real time, verify execution quality, and access audit trails.

Can I watch the auction process in real time?

Customizable Auction

Customizable Auction

Compliance & Reporting

Details regulatory compliance, reporting, and how QwickRoute simplifies trading relationships.

Is aRFQ™ fully compliant with Reg NMS requirements?

Is aRFQ™ compliant with CAT reporting requirements?

Do I need trading relationships with each liquidity provider?

Order Routing & Execution

Covers how orders are routed, qualified, auctioned, and executed through QwickRoute’s aRFQ™ workflow.

How can I route orders to QwickRoute?

How does QwickRoute aRFQ™ execute orders?

What if I send multiple orders in one symbol?

Transparency & Monitoring

Explains how clients can monitor auctions in real time, verify execution quality, and access audit trails.

Can I watch the auction process in real time?

How do I know an order has received best execution?

Can I receive an audit trail for each auction?

Compliance & Reporting

Details regulatory compliance, reporting, and how QwickRoute simplifies trading relationships.

Is aRFQ™ fully compliant with Reg NMS requirements?

Is aRFQ™ compliant with CAT reporting requirements?

Do I need trading relationships with each liquidity provider?

Order Routing & Execution

Covers how orders are routed, qualified, auctioned, and executed through QwickRoute’s aRFQ™ workflow.

How can I route orders to QwickRoute?

How does QwickRoute aRFQ™ execute orders?

What if I send multiple orders in one symbol?

Transparency & Monitoring

The On-Demand Liquidity Auction is a proprietary QwickRoute algorithm that leverages a competitive auction process to aggregate liquidity from multiple counter-parties. A single, optimized execution price with minimal slippage and market impact.

Can I watch the auction process in real time?

Customizable Auction

Customizable Auction

Compliance & Reporting

Details regulatory compliance, reporting, and how QwickRoute simplifies trading relationships.

Live Order Monitoring

Adaptive Algo Controls

Adaptive Algo Controls

Ready to Trade with Transparency?

Explore how QwickRoute can help you source liquidity, enhance execution quality, and reduce trading costs.

Ready to Trade with Transparency?

Explore how QwickRoute can help you source liquidity, enhance execution quality, and reduce trading costs.

Ready to Trade with Transparency?

Explore how QwickRoute can help you source liquidity, enhance execution quality, and reduce trading costs.

Ready to Trade with Transparency?

Explore how QwickRoute can help you source liquidity, enhance execution quality, and reduce trading costs.